Save a Donor

“I love what we do,” the Board member told me. “Our cause is amazing, but I won’t introduce my friends and colleagues to the organization.” I hear words to this effect all to often. Great mission, good programs, lousy treatment of donors. It’s the latter that is causing all the problems.

Bad stewardship—or no stewardship at all—will not only make you lose donors, it will prevent you from getting donors, and often the potentially biggest donors, in the first place. If your board doesn’t think that you treat your donors well, they won’t want to bring them to the table. And that is tremendous loss. But it is far from the only loss.

Donor attrition is a huge problem for nonprofits. All studies point to the depressing fact that each year we are losing serious ground. For every new dollar raised, we lost more than a dollar; for every new donor we get, we lost a significantly higher number. And this doesn’t count the phantom donors—those who are there but you can’t get to.

All too often, stewardship is defined as sending a thank you letter. And all too often, even this step is overlooked. But stewardship is so much more. Considering stewardship in its broadest sense, it involves planning and managing your resources. In the case of nonprofit, one of our most valuable resources is our donor base.

Good stewardship starts with defining the stewardship strategy for a donor or a group of donors. And the first step of that is clarifying (with the donor!) how you will recognize the donor’s generosity. Donor recognition goes from ensuring to keep the donor’s confidentiality by keeping the donor’s name, the size of the gift, or anything else the donor requests, out of the public eye, to emblazoning the donor’s name on a program or building. It is critical that you and your major donor agree on this. It is wonderful if your annual donors know what they can expect—and then get what they have been told they are getting.

That, of course, is the second step of good stewardship. This starts with acknowledging that you have received this gift (or this pledge). For a gift, this is the document that also provides the donor with any tax information he or she needs for tax purposes. This should be non-negotiable. It’s something every donor, regardless of the size of the gift, should get. And they should get this within 48 hours of you receiving the gift. If what you get is a pledge, then a signed pledge agreement should be shared with the donor.

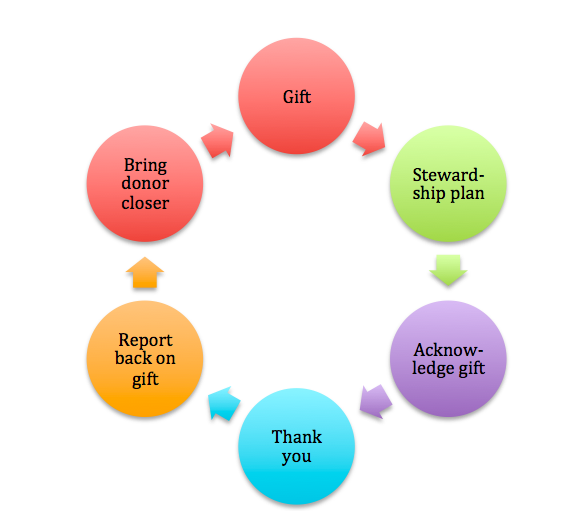

At this point, your stewardship strategy starts getting personalized—but all stewardship plans will follow the same trajectory. Visually, it looks like this:

Once you acknowledge, you then thank. Yes, I KNOW your acknowledgement is in the form of a thank you letter. So what? You can’t send another, more personal thank you? How would this hurt? Now think how much it could help.

Connecting the dots for your donor will also help. Showing how the gift—very specifically for major gifts, more generically for annual or smaller ones—made a difference will truly make a difference in your donor retention rates.

All of this feeds into what you must constantly and consistently do: Bring your donor in closer. All fundraisers know that your best prospect for a gift is an existing donor. It makes me nuts when I hear people say, “We can’t bother Joe for this, he just gave a gift.” The act of giving one gift makes Joe the obvious prospect for a second gift, assuming the project, the amount and the timing are right. But if Joe doesn’t feel part of the team, he won’t want to play ball—and that will mean that Joe will become part of the dismal statistics on donor attrition.

Even more importantly, as you begin to treat your donors right—do the things that keep them and bring them closer—your Board members will start to think, “I want my friend or colleague to experience this,” and they will become willing to introduce them to your organization.

Janet Levine works with nonprofits and educational organizations, helping them to increase their fundraising capacity. Learn more at http://janetlevineconsulting.com. While there, sign up for her free newsletter.